A 4% initial withdrawal with annual CPI increases thereafter has a 94% probability of success over 30 years. If the retiree skips CPI increases in years in which their withdrawal rate exceeds the Target Percentage, the probability of success increases to 100% (99.8%).

If the retiree takes an initial withdrawal of 6% of their portfolio and agrees to skip CPI increases in years in which their withdrawal rate exceeds the Target Percentage, their probability of success over 30 years is 93%.

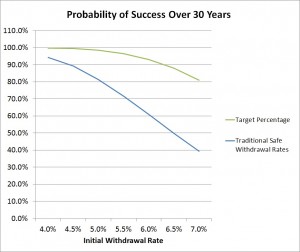

Success rates over 30 years are shown below.

IWR TSWR TPA

4.0% 94.3% 99.8%

5.0% 81.4% 98.5%

6.0% 61.0% 93.1%

7.0% 39.4% 80.9%

IWR = Initial Withdrawal Rate

TSWR = Traditional Safe Withdrawal Rate (full CPI increase each year)

TPA = Target Percentage Adjustment (skip CPI increase only in years in which the TP test is failed)

Do you think 93% confidence is safe? If so, then a 6% initial withdrawal rate is safe as long as inflation increases are subject to passing the Target Percentage test each year.

The above statistics are from the research for my January, 2013 Journal of Financial Planning article, “Achieving a Higher Safe Withdrawal Rate With the Target Percentage Adjustment.”

Here is a graph of the data from the table above. Click on it to enlarge it.

Keywords: 4% Rule, 4 Percent Rule, Safe Withdrawal Rate, Spending in Retirement, Dynamic Withdrawal Strategy, Adaptive Withdrawal Technique, Retirement Planning, Will I outlive my money?